Before and After Six Months of Practice

- Starting point: Most participants join us knowing spreadsheets but struggling to spot meaningful patterns when comparing quarterly reports across three or four companies simultaneously.

- Three months in: They're building their own comparison frameworks—still making mistakes, but catching them faster and knowing which metrics actually matter for different industry contexts.

- Six months later: The difference shows up in how they approach new analysis requests. Instead of getting overwhelmed, they break down complex comparisons into manageable pieces and explain their reasoning clearly to non-technical stakeholders.

- Real scenario: One recent graduate used these methods to help a local investment group evaluate five logistics companies. No guarantees on outcomes, but she knew how to structure the comparison and defend her analysis.

Three Phases That Actually Build On Each Other

We don't separate theory from practice because that's not how analysis works in real jobs. Each phase takes about eight weeks, and you'll work with actual Vietnamese company data throughout.

Foundation Research

You'll spend time understanding what makes companies comparable in the first place. We look at market positioning, revenue structures, and operational models—then practice identifying what's similar enough to analyze side by side.

Metric Development

This part gets into the details of building comparison frameworks. We work through margin analysis, growth pattern recognition, and efficiency ratios—focusing on methods that hold up when your boss asks challenging questions.

Report Construction

The final phase centers on communicating your findings. You'll create comparison reports that executives can actually use, learning how to present complex analysis without overwhelming your audience or hiding important caveats.

Who Teaches These Methods

Our instructors work as analysts during the week and teach on weekends. They bring current challenges from their own projects into the classroom.

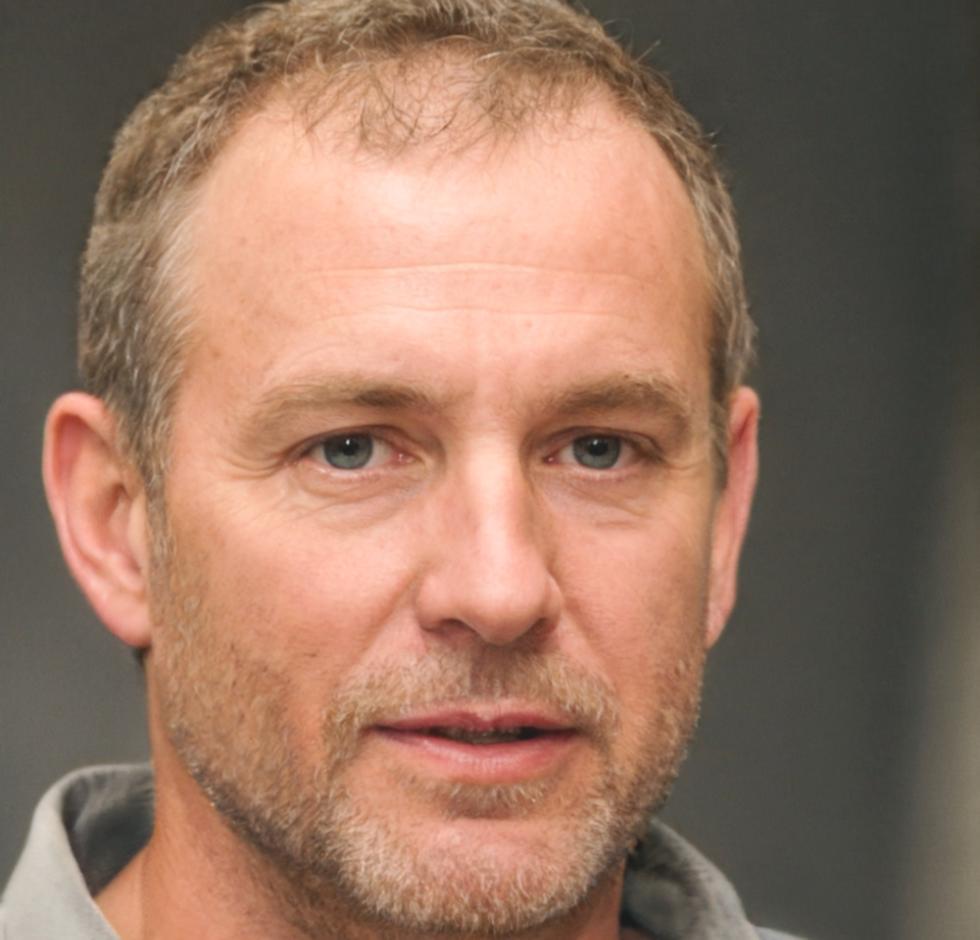

Davin Torvaldsen

Corporate Analysis Lead

Davin spent eight years comparing manufacturing companies for acquisition teams. He's blunt about what works and what wastes time—which students appreciate when they're neck-deep in confusing data.

Henrik Svendsen

Financial Modeling Specialist

Henrik works with retail sector analysis and brings real quarterly reports into class. His approach focuses on building models that don't fall apart when assumptions change.

Tomasz Kaczmarek

Strategic Research Analyst

Tomasz specializes in cross-border comparisons and teaches the trickiest part—making sense of different accounting standards and reporting practices across Southeast Asian markets.

Program Timing and What to Expect

We're opening enrollment for our September 2025 cohort in early July. The program runs for six months with weekend sessions at our Thanh Hoá location. You'll need around 15 hours weekly for coursework and project work between sessions.

Class size stays small—we cap it at eighteen participants so instructors can give detailed feedback on your analysis work. Most students juggle full-time jobs alongside the program.

- Early July 2025: Application period opens with requirements review

- Mid-August 2025: Accepted participants receive preparatory materials

- September 7, 2025: First weekend session begins foundation phase

- March 2026: Final presentations and program completion